Improve Your Credit Score: 5 Expert Tips to Save Thousands on Your Mortgage

In today’s high-er interest rate environment, your credit score holds the key to unlocking significant savings on your mortgage. As a seasoned Realtor and Mortgage Broker, I’ve shared invaluable insights in my recent video, outlining five expert strategies to improve my credit score and secure a better mortgage rate. Let’s dive into these tips and learn how optimizing to improve your credit score can lead to substantial financial benefits and savings over the long term.

Understanding What a Credit Score Is and How It Impacts You

Before diving into the strategies, let’s understand what a credit score is and its significance. A credit score is a numerical representation of your creditworthiness, reflecting your ability to manage debt responsibly. It’s important to note that there are various credit score models from each of the three credit bureaus—Experian, TransUnion, and Equifax. Each bureau uses its own algorithm to calculate your credit score based on the information in your credit report. However, the actual credit score used for mortgages is typically only available from a mortgage lender.

Lenders use your credit score to assess the risk of lending to you. Factors such as payment history, credit utilization, length of credit history, credit mix, and recent inquiries all play a role in determining your credit score. A higher score indicates lower risk to lenders, making you eligible for better loan terms, including lower interest rates.

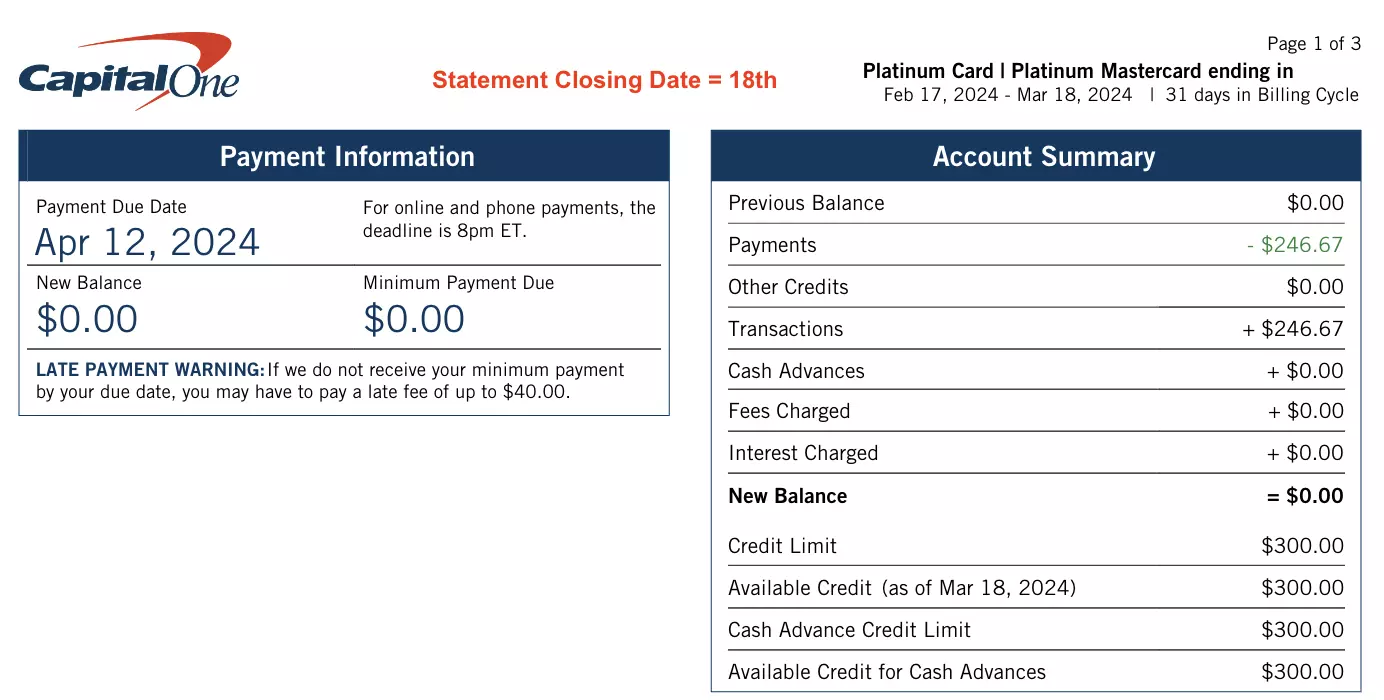

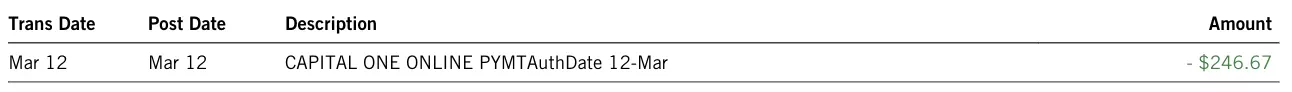

Tip #1: Strategic Payment Timing to Optimize Your Credit Report

One of the fundamental strategies you can employ is strategic payment timing. By understanding your credit card statement date and strategically making payments before it arrives, you can effectively lower your credit utilization ratio, thereby improving your credit score.

For example, let’s say your credit card statement date falls on the 25th of each month. If you make a payment a few days before the 25th, ensuring that it is processed before the statement is generated, you can ensure that the lower balance is reported to the credit bureau. This proactive approach demonstrates responsible financial management to lenders, positioning you as a more favorable borrower. By staying ahead of your credit card payments and keeping your balances low, you can optimize your credit score and increase your chances of securing favorable loan terms.

Tip #2: The AZEO Method for Credit Card Balances

Discover the AZEO (All Zero Except One) method—a proven tactic for optimizing your credit card balances. This method entails maintaining zero balances on two or more credit cards, while making sure to only keep a 9% balance on one of your credit cards.

It’s important to note that having all your credit cards at a $0 balance can actually cause your credit score to go down. Lenders want to see that you’re actively using credit and managing it responsibly. By strategically keeping a small balance on one card while keeping the others at $0, you can demonstrate responsible credit management without accruing unnecessary debt.

Implementing the AZEO method can potentially boost and improve your credit score by up to 100 to 150 points. This significant increase in your credit score can open doors to better loan terms, lower interest rates, and ultimately save you thousands of dollars over the life of your mortgage.

By following this strategy, you not only improve your creditworthiness but also increase your chances of receiving favorable loan terms and achieving your financial goals. With disciplined credit management and the AZEO method in place, you can pave the way for more options at better terms.

AZEO Example:

| Credit Card | Credit Limit | Target Balance |

|---|---|---|

| Credit Card #1 | $2,000 | $180 ($2,000 x 9%) |

| Credit Card #2 | $500 | $0 |

| Credit Card #3 | $300 | $0 |

Tip #3: Diversify Your Credit Mix

Alright, let’s dive into another strategy to improve your credit score. One of the key things you can do is to diversify your credit portfolio. Now, I know there’s this misconception out there that you have to go into debt to improve your credit score. But trust me, that’s not the case.

Improving your credit score is all about showing lenders that you’re responsible with your finances. And one way to do that is by having a mix of credit cards and installment loans. This shows lenders that you can handle different types of credit responsibly, which can give your credit score a nice little boost.

So, you need to add an installment loan. You only need ONE installment loan, like a personal loan, student loan or an auto loan, to round out your credit profile. This will improve your credit score by up to 10%

Tip #4: Addressing Past Credit Issues

If you’ve faced some bumps in the road with your credit history, don’t sweat it—there are steps you can take to lessen their impact.

Reach out to your creditors and ask for goodwill adjustments, where they remove late payments from your credit report as a one-time favor.

Also, consider negotiating “pay for deletion” deals with collection agencies to get negative accounts removed from your report. Removing late payments, collection, and charged-off accounts from your credit report can boost your credit score 100-150+ points

Tip #5: Minimize Credit Inquiries

Alright, here’s the deal when it comes to credit inquiries: every time you apply for credit, your credit score might take a little hit. But don’t sweat it too much. To keep that hit to a minimum, I always recommend keeping unnecessary credit inquiries in check.

And here’s a little insider tip: take full advantage of the 14-day window for mortgage or auto loan shopping. During this time, multiple inquiries from lenders will show up on your credit report, BUT will only count against your score as 1 credit inquiry, which helps lessen the overall impact on your credit score.

It’s why I tell all my clients, whether they’re working with me for their mortgage or not, to shop around. It ensures they’re comfortable with the rate and cost of their new mortgage.

Conclusion: Take Charge of Your Financial Future

Alright, wrapping it up here. Mastering your credit score is key to reaching those homeownership dreams and snagging the best mortgage deals. So, take these expert tips to heart and manage your credit like a pro. Trust me, it’ll pay off big time. Start now, don’t delay. Get on track to homeownership success by boosting your credit score today. You’ve got this! Feel free to drop a comment or question below!